On Monday, March 28, 2022, President Biden submitted his budget proposal to Congress for the 2023 fiscal year. The budget would reduce the national deficit by approximately $1 trillion over 10 years primarily by increasing the corporate tax rate to 28% and introducing a minimum tax on total income, including unrealized gains, of highest earners. The White House also released the General Explanations of the Administration’s Fiscal Year 2023 Revenue Proposals, commonly known as the “Green Book,” a more detailed description from the Treasury Department of the administration’s tax and revenue proposals.

Biden’s newly released $5.8 trillion plan makes a number of budget increases in several areas in an effort to garner the approval of moderate Democrats and Republicans alike as part of his “Unity Agenda.”

Spending Provisions

Some of the significant spending provisions in Biden’s plan include the following:

Defense – $813B for defense-related programs, including a 4.6% pay raise for U.S. troops

Law Enforcement – $33.2 billion for law enforcement, crime prevention and community violence intervention programs

IRS Enforcement – $14.1 billion, an increase of 18% over the 2021 enacted level, to improve enforcement of underreporting taxpayers and to improve customer service and administration efficiency for all taxpayers

Foreign Affairs – an increase of 18% over 2021 fiscal levels

- Funding for international programs including the World Bank

- Assistance for global efforts on the climate and health security stage

- Assistance for Ukraine

Cybersecurity – 24% increase for securing federal civilian computer systems and combatting cybersecurity threats

Energy – repealing the tax breaks and credits for oil and gas drillers

- $11 billion to help other nations deploy clean energy and help combat climate change

- $18 billion for the U.S. to address global warming

- Intangible drilling costs would no longer be able to be deducted

- Deduction for oil and gas production from marginal wells would end

- $200M used to create a domestic solar manufacturing sector

Revenue Provisions

In order to help fund these initiatives, the plan calls for additional tax rate hikes primarily in the form of raised taxes for corporations and wealthy individuals.

Higher Corporate Tax Rate

The budget calls on the tax rate for C corporations to be raised from 21% to 28%.

Mega-millionaire and Billionaire Minimum Tax

Under the administration’s billionaires’ minimum income tax proposal, the top one-one hundredth of one percent (0.01%) of American households – those worth over $100 million – would pay a minimum tax of 20% on all of their income, including unrealized investment income that currently is untaxed. According to a fact sheet released by the White House, revenue collected under this tax would reduce the deficit by about $360 billion over the next decade.

This provision brings into play a level of complexity that some observers would argue is unrealistic. From questions about the value of the unrealized gains or losses and at what date the value should be calculated, to what happens when the assets are sold if an individual is on a payment plan and sells the assets before the plan is complete, are just a few of the obstacles needed for clarification. This will undergo extreme scrutiny by Congressional members.

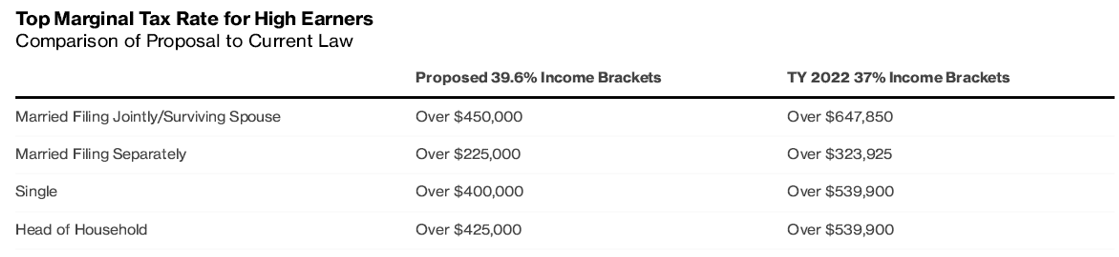

Top Marginal Individual Income Tax Rates

In addition, the proposal is calling on the individual income tax rate to be raised from 37% to 39.6% on the U.S.’ highest earners.

Long-term Capital Gains and Qualified Dividends of High Earners

The proposals also include taxing long-term capital gains and qualified dividends of taxpayers with taxable income of more than $1 million ($500,000 for married filing separately) at ordinary rates (40.8 percent including the net investment income tax).

Recapture of Real Property Depreciation

One provision would require 100% recapture of ordinary income of depreciation deductions taken on certain depreciable real property, excluding noncorporate taxpayers with taxable income of less than $400,000.

As we’ve seen in the past, the final product may look nothing like what is presented today, if it even makes it across the finish line. However, as these details evolve throughout the budget process, we will continue to keep you updated with pertinent information that may affect you and your business. If you have any questions, please feel free to contact your BMSS professional at (833) CPA-BMSS or visit our website at bmss.com.