10 Best Practices for Road Builders

In a presentation to our construction industry niche group, Robert Davidson presented his top 10 list of the most common causes of contractor failure as well as his 10 best

Read More

In a presentation to our construction industry niche group, Robert Davidson presented his top 10 list of the most common causes of contractor failure as well as his 10 best

Read More

A discussion about the new streamlined process for applying for a project-specific exemption certificate was presented to BMSS in a memo written by Bradley Partners, Bruce P. Ely and James E.

Read More

Written by Steven M. Platau, J.D., CPA The Corporate Transparency Act requires many newly formed entities in 2024 to make a Beneficial Ownership Interest (BOI) filing with the Treasury Department’s

Read More

You may or may not be aware that starting January 1, 2024, many businesses will be required to comply with the Corporate Transparency Act (CTA). The CTA was enacted into

Read More

Effective January 1, 2024, BMSS Advisors & CPAs proudly added two new Members to the firm bringing the total number to 34. This announcement follows an eventful close to 2023

Read More

The wage base limit is the maximum wage that is subject to Social Security tax for that year. In 2023, the Social Security Wage base was $160,200 and is increasing

Read More

Written by Dalton Hopper, CFE, CVA As part of the 2017 Tax Cuts and Jobs Act, the gift and estate lifetime exclusion amount was raised and is currently set to

Read More

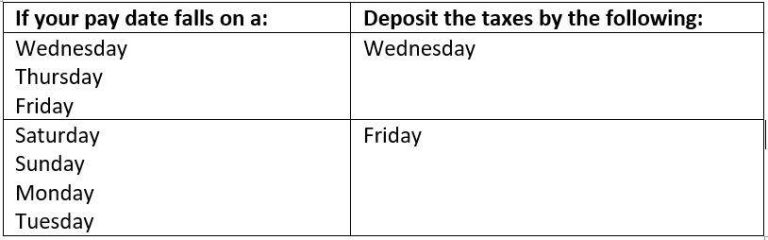

IRS Notice 931, Deposit Requirements for Employment Taxes, https://www.irs.gov/pub/irs-pdf/n931.pdf list requirements for depositing payroll taxes such as federal income tax, social security and Medicare tax. If your company is currently

Read More

By Rebecca Tipton, SHRM-SCP HR Advisory Services We are officially in the final days of 2023, which is historically a time for celebration! However, before you break out your noisemakers

Read More

As we approach the end of 2023, it’s essential to plan ahead to ensure that you are well-prepared for the upcoming tax season. Whether you’re an individual, a business owner,

Read More

Alabama recently updated the state-level sales tax rate on food, reducing it from 4% to 3%, effective September 1, 2023. This does not affect local jurisdiction rates such as city

Read More

Beginning October 1, 2023, the OPPAL system will be a component of My Alabama Taxes to electronically file your business personal property return. If you (or BMSS on your behalf)

Read More