Using Data to Measure Morale

Written by Becca Riles, Business Intelligence Analyst, Abacus Technologies Did you know that using data to measure morale within a company is essential for several reasons? Morale refers to the

Read More

Written by Becca Riles, Business Intelligence Analyst, Abacus Technologies Did you know that using data to measure morale within a company is essential for several reasons? Morale refers to the

Read More

In a presentation to our construction industry niche group, Robert Davidson presented his top 10 list of the most common causes of contractor failure as well as his 10 best

Read More

CFMA Article written in 1986 by Robert Davidson and Danny Parrish In a presentation to our construction industry niche group, Robert Davidson presented his top 10 list of the most

Read More

A discussion about the new streamlined process for applying for a project-specific exemption certificate was presented to BMSS in a memo written by Bradley Partners, Bruce P. Ely and James E.

Read More

What is E-Verify? E-Verify is an Internet-based system that allows employers to confirm newly hired employees are legally authorized to work in the United States. The E-Verify system compares information

Read More

In response to the increasing number of potentially ineligible Employee Retention Credit (ERC) claims, the IRS has recently launched two pivotal programs for businesses navigating the complexities of the ERC:

Read More

For corporate entities registered with the Alabama Secretary of State (ALSOS), beginning January 1, 2024, the ALSOS Corporation Annual Report is no longer reported with the Annual Business Privilege Tax

Read More

In today’s ever evolving world of accounting guidance and regulatory compliance, it’s more important than ever to stay on top of what standards have been issued by the Financial Accounting

Read More

Written by Drew Nicol, CPA Social Security has been a staple of financial security for millions of Americans since 1937 providing essential support during retirement, disability, and other life-altering circumstances.

Read More

The wage base limit is the maximum wage that is subject to Social Security tax for that year. In 2023, the Social Security Wage base was $160,200 and is increasing

Read More

Written by Dalton Hopper, CFE, CVA As part of the 2017 Tax Cuts and Jobs Act, the gift and estate lifetime exclusion amount was raised and is currently set to

Read More

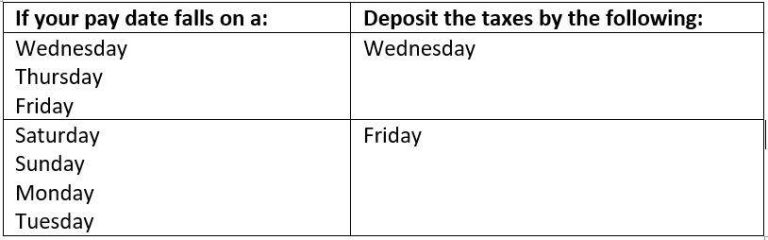

IRS Notice 931, Deposit Requirements for Employment Taxes, https://www.irs.gov/pub/irs-pdf/n931.pdf list requirements for depositing payroll taxes such as federal income tax, social security and Medicare tax. If your company is currently

Read More