A confluence of rising inflation and interest rates, supply chain disruption and volatile consumer demand are setting the stage for an economic downturn. Many prominent business leaders and economists contend that the U.S. economy could fall into recession by 2023, if not earlier.

Although now we are in a gray zone where we do not know if a recession will strike, how long it will last or its severity, companies should take decisive action to prepare.

By looking at the performance of companies during previous recessions, we can see organizations that took proactive steps to prepare were best positioned to achieve hyperspeed value coming out of the recession.

So how do you turn the gray zone into a silver lining?

Here is a look at the five strategic moves to make now to navigate the turbulence ahead.

VARIABILIZE YOUR COST STRUCTURE

In a recession, fixed costs are a liability. The more fixed costs you have, the more revenue you need to generate to break even, and the harder it is to rapidly scale up or scale down. If you variabilize your cost structure—reducing fixed costs and shifting to a more variable cost base—you can significantly increase your capital efficiency and financial flexibility. There are two primary levers to variabilize costs:

- Large-scale cost reduction initiatives, where fixed costs are rationalized.

- Cost transformation, where fixed costs are converted into variable ones.

The former typically involves the elimination of low-value activities and overhead—familiar territory to most businesses. The latter, on the other hand, can involve anything from outsourcing and offshoring to new contract financing agreements to operating model changes. For instance, a manufacturer may opt to sell off equipment it owns and shift to renting on a pay-per-use basis. Or a biopharmaceutical company could opt to contract out all clinical trials instead of continuing to own its own lab facilities. It is not an either/ or—used in concert, these two levers can drive significant cost savings and scalability. For example, you could consolidate your IT portfolio to reduce fixed IT costs—and you could shift IT provisioning to a pay-as-you-go cloud computing model.

Adjusting your cost base requires a clear understanding of what’s important and what’s not—and a willingness to challenge the status quo. No historical costs are set in stone; you need to validate the effectiveness of, and return on, capital deployment.

How to Variabilize Your Costs

- Establish internal benchmarks, identifying what constitutes the “best of the best” and the “worst of the worst” to pinpoint the low- or no-value activities.

- Optimize your staffing by reducing the layers between management and the customer.

- Map out cost distribution by market, product/ service line and customer vertical.

- Leverage the 80/20 principle to methodically reallocate resources away from lower-value activities to the business activities of highest value.

- Reimagine your biggest fixed costs—negotiate variable payment terms with suppliers, outsource noncore business functions or shift from asset ownership to renting for access.

SPOTLIGHT: ZERO-BASED COSTING

An offshoot of zero-based budgeting, wherein budgets are reset at zero at each new budgeting period rather than working from historical numbers, zero-based costing is a framework for separating good costs from bad costs across the entire P&L. Starting from a clean sheet, each line item must be justified based on need and cost. If required spend is disproportionate to the need, the cost structure should be rethought.

The goal isn’t only to reduce overall spend, but also to identify cost inefficiencies and reallocate resources to the areas of the business that drive the greatest value and differentiation. Dollars freed up can be used to jump on near-term opportunities or go towards funding longer-term strategic investments.

Organizations should follow four critical steps to conducting a zero-based costing review:

4 Steps to Zero-Based Costing

Short-Term Impact Challenge demand and non-value-added activities

Metrics-Depicted Cost Structure Build metrics foundation to justify cost structure

Design Packages Assess cost opportunities and develop alternatives

Results and Culture Shift Cut, optimize, extend and continuously improve

- A zero-based method forces the organization to evaluate and prioritize the resources necessary for the company to be successful.

- Radical operating model changes (e.g. outsourcing, front-office shifts, complexity reduction) should be considered.

- Effect on culture cannot be overlooked.

- A single cost management thrust that addresses both short-term targets and long-term ambitions is most effective.

PAUSE FOR PROFITABILITY

Your business may be at the mercy of uncertainty, but in pausing, there is opportunity for reflection and rectification. Don’t squander this time: use it to tackle the inefficiencies you couldn’t get to when you were going full tilt. Catalogue the projects and problems you have on the backburner and prioritize those that will reap the biggest payoffs in profitability and productivity. Think of it as a deep clean for overlooked or hidden areas of business waste. Perhaps there are lingering integration gaps from prior acquisitions— legacy systems still in place, disconnected processes, disjointed teams or even competing solutions. Cross-functional integration over the years may have also seeded redundant activities and processes, resulting in duplication of effort, inconsistencies, and longer timeframes. Or perhaps there are more systemic cultural issues contributing to inefficiency and excess spend—for example, poor program management. When the pause ends, meeting project timelines and goals will be key to turning opportunity into competitive advantage. While you’re waiting for the next big project to start, analyze and address the gaps in your current project management practices. Addressing inefficiencies from projects that got put on the back burner is just one piece of the profitability puzzle. Look for the tell-tale signs of margin erosion and address the culprits behind them.

Profitability Pitfalls

- Bumps in procurement costs over the years

- Bloated products and service lines

- Overly aggressive discounting

- Sub-optimal pricing

- Scope creep

PROFITABILITY THROUGH PORTFOLIO OPTIMIZATION

For many businesses, real estate represents one of the biggest contributors to fixed costs. As COVID-19 continues to challenge traditional notions of what it means to “go to work,” it is an opportune time to hit the reset button on your real estate assets and occupancy costs. Consider the following actions to optimize your real estate portfolio and reduce costs:

- Develop a clear understanding of current state portfolio performance (Total Occupancy Cost, Occupancy Cost as a % of Revenue, Occupancy Cost Per Employee).

- Challenge traditional space paradigms: Determine your ideal future real estate portfolio composition, considering a balance of hub, flex space and work-from-home strategies.

- Complete a gap analysis quantifying cost to achieve current state versus future state.

- Identify and eliminate space in the current portfolio that is under-used, “dark space,” or no longer profitable.

- Complete a footprint optimization analysis to identify locations for consolidation and closure.

- Review and evaluate key lease provisions for early termination options, sublease rights, etc.

- Restructure/renegotiate leases and contracts for workplace services to capture savings in changed market conditions.

- Evaluate facility support contracts for renegotiation/rebidding.

- Review construction and other capital project commitments.

- Build a comprehensive implementation roadmap to support key initiatives and track savings progress.

SEGMENT AND SIMPLIFY

Variety might be the spice of life, but now is the time for businesses to go on a slimming diet. In an interview with The Wall Street Journal, IGA Inc. Chief Executive John Ross noted, “We may not need 40 different choices of toilet paper.” He’s right: More variety means more complexity and more cost. If demand for any given variant in your product or service mix isn’t sufficient to offset the higher costs, it needs to be shelved. Too much complexity in the business, whether the result of unwieldy product portfolios, proliferating distribution channels, convoluted processes or too much bureaucracy, torpedoes profitability. To unlock that profitability, rethink your business model to serve target customers more simply and effectively.

Simplification should start with segmentation to help you understand where you need to focus. Apply the 80/20 principle to analyze sales and profitability by segment. The analysis will uncover the “critical few” product or market segments that are generating the most revenue and profit, as well as the “insignificant many” that require significant cost and effort to support. By overlaying product and customer performance for each market in a “Quad Analysis,” you can uncover what products and services your most important customers are buying, as well as where you’re allocating a disproportionate amount of resources for low returns. Once you’ve identified the business segments driving the most value, realign your organization around those strategic focus areas, setting clear financial targets for profitability. Create a framework for rationalization and a portfolio of re-engineering projects to provide enhanced service to the most profitable customers at reduced cost.

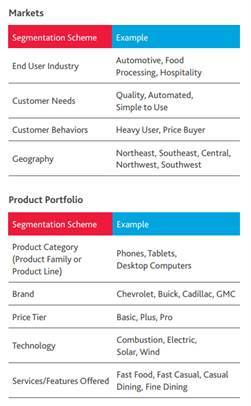

Segmentation Schemes

Look for the intersection between markets and products.

SIMPLIFICATION & SEGMENTATION IN ACTION / A LEGO CASE STUDY

In 2004, LEGO was on the brink of bankruptcy. In the previous decade, Lego had significantly expanded its portfolio into products and experiences only tangentially related to its iconic plastic bricks—launching LEGO clothes and jewelry, video games and even theme parks. Not every innovation was a failure: the company introduced collaborations with the creators of Harry Potter and Star Wars that flew off the shelves. But these successes were not enough to offset increasingly complex and expensive production costs.

The company decided to return to its roots and focus on its core product offering: the classic LEGO brick. The theme parks and computer sales businesses were sold off, retail expansion was slowed down, and the product portfolio was simplified, cut by 30%.

For LEGO, going “back to the brick” meant a focus on quality over quantity, a premium pricing strategy, and a greater focus on end user feedback. The “Apple of Toys” went on to generate double-digit revenue growth for the next 10 years straight.

OPTIMIZE YOUR VALUE CHAIN

For the first few months of the pandemic, most businesses prioritized de-risking their supply chains—even at the expense of higher costs. Some short-term cost control measures may have been instituted, but there is ample opportunity to further optimize your supply chain for permanent cost reduction, capital efficiency and profit improvement. As you evaluate de-risking strategies, make sure you don’t leave cost out of the equation. Approached in the right way, supply chains can be reconfigured to reduce risk and costs. And while larger value chain transformation may be off the table for some companies until the economy improves, there are several levers to pull that can deliver significant near-term savings.

Near-Term Opportunities to Reduce Supply Chain Risk and Cost

- Perform spend analysis and focus on those suppliers who have been most consistent in delivering on time and high quality and who offer the best pricing opportunities.

- Ensure you have at least one back-up supplier in a different geographic or trade region to minimize risk of shortages.

- Reduce transportation costs by shortening routes or using more cost-effective modes of transportation.

- Evaluate internal cash positions and established intercompany financing arrangements to ensure ability to efficiently use existing cash.

- Leverage segmentation principles to align customer service levels, costs and capital allocation for different subsets of customers and products.

- Perform SKU segmentation to improve ordering and forecasting accuracy.

- Consider low-risk country sourcing options, tax laws and financial incentives for relocation.

- Revisit existing transfer pricing protocols through a recessionary lens.

- Eliminate manual input and invest in tools to automate the Procure to Pay processes including supplier management, purchase order issuance, approval workflows, purchase categorization, budget tracking and reporting.

- Evaluate corporate policies and supply chain participation to better understand current and near term ESG opportunities and compliance with labor laws and ethical work practices.

PLAN PROACTIVELY

Figuring out your next big move should happen before you’ve accumulated the capital you need to make it. After all, how can you calculate your capital requirements if you don’t yet know where you want to invest? Now is the time to re-tool your strategic plan. While it may feel uncomfortable to think about new expenditures in the current economic environment, now is the time to identify potential opportunities for competitive advantage and increased operating leverage and prioritize them. Putting together a plan to capitalize on those strategic opportunities should take place well before you are ready for execution.

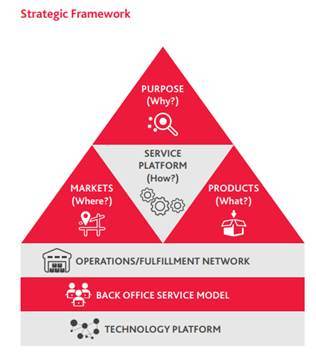

Building Your Strategic Plan

- Define your “North Star”—the strategic play that will drive lasting competitive advantage and business value.

- Develop a portfolio of short-and medium-term actions that support your strategic vision.

- Prioritize actions, focusing on those that will deliver rapid ROI and move the needle.

- Include the run-rate expense reductions, one-time implementation cost and estimated time frame to implement the agreed-upon priority capital projects.

- Put some meat on the bones—identify the different project work streams needed to achieve the desired outcomes, assign work stream owners, and establish clear milestones.

While the trajectory of the economy remains unclear, your business can still make forward momentum towards recovery. There is a silver lining in this gray zone for every middle market organization—if you know where to look.

In the words of Leonardo da Vinci, a gray day provides the best light.