Written by Dalton Bradshaw, CPA

Since the 1980s, the cost of a college education has continued to increase exponentially, nearly tripling, even after factoring for inflation. The continual cost increase for a college education over the last 40 years, coupled with stagnating wages and the increased cost of living, have caused much of the American population to be saddled with crippling debt from their college educations. Considering these issues, the push for federal student loan forgiveness has been a key political topic to garner support from Americans struggling to pay off their loans. Until recently, proposals surrounding student loan forgiveness have struggled to gain any traction in Washington.

However, on August 24, 2022, President Biden announced that his administration would be following through with a campaign promise to reduce federal student loan debt in a three-part plan to be rolled out in the Fall of 2022. The plan will potentially provide relief to approximately 43 million borrowers by providing targeted debt relief, revising qualifications for the Public Service Loan Forgiveness (PSLF) program, and revising income-driven repayment plans.

Targeted Debt Relief

The most notable portion of Biden’s plan comes in the form of targeted debt relief. The plan provides for up to $20,000 of debt cancellation for Pell Grant recipients and up to $10,000 for non-Pell Grant recipients, per person, subject to income limitations. Cancellation is available to single and married filing separate taxpayers with $125,000 or less of adjusted gross income (AGI) and married filing jointly, head of household, and qualifying widower taxpayers whose AGI is less than $250,000, for 2020 or 2021.

To receive federal student loan debt relief, borrowers must complete a simple application on the Federal Student Aid website. Borrowers will need the following information to complete the application:

- Full Legal Name

- Social Security Number

- Date of Birth

- Phone Number

- Email Address

The link to the debt relief application can be found here. Once submitted, the Department of Education will review the application to determine eligibility. Borrowers will be notified by their loan service provider once the forgiveness has been processed. In addition to the debt relief, the plan extends the pause on federal student loan repayments through December 31, 2022. Biden’s administration indicated that this would be the last extension and borrowers should expect to resume payments in January 2023.

Revisions to the PSLF program

The PSLF program was created in 2007 by Congress to incentivize people to work in public service roles. The program allows up to $100,000 of loan forgiveness to borrowers who work in public services (police, firemen, etc.) for 10 years and make timely payments through an income-driven repayment plan on their direct federal student loans during this period (120 payments). However, reports from the Department of Education have indicated that up to 99% of PSLF waiver applications have been denied since its inception. The majority of waiver rejections were due to an incorrect repayment plan, ineligible loans, and ineligible employers.

Under Biden’s plan, the program will allow many more borrowers to qualify for forgiveness by removing some commonly missed qualifications. The program now defines “qualifying” payments to include payments on installment, late payments, and lump-sum payments. Previously, payments could be disqualified for being pennies short or more than 15 days late. Additionally, the program now defines full-time employment as a minimum of 30 hours per week, as opposed to 40 hours previously.

Borrowers that are eligible for forgiveness under PSLF and have their loans managed by the Department of Education should expect a one-time account adjustment in July 2023 to account for changes to the PSLF program. Additionally, borrowers with ineligible loans that would have qualified for PSLF otherwise, may now reap the benefits of this one-time adjustment if their loans have been consolidated into Direct Loans by May 1, 2023.

Revisions to Income-Driven Repayment (IDR) Plans

Although it has not made as many headlines, one of the most impactful portions of the plan to borrowers comes in the form of revisions to income-driven repayment (IDR) plans. IDR plans were created to provide a more affordable monthly payment to borrowers but have often led to missed or late payments. This, in turn, causes the loans to balloon as interest continues to compound on the outstanding balances.

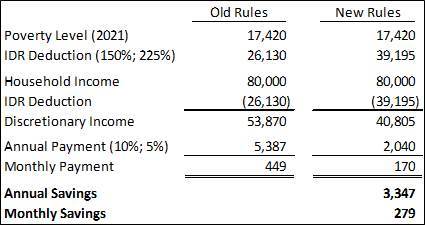

Previously, IDR plans calculated monthly payments for borrowers based on 10% of their discretionary income which the Department of Education determined by subtracting 150% of the federal poverty level from a borrower’s household income. The revisions to IDR plans seek to help borrowers by decreasing the percentage of discretionary income used to calculate payments from 10% to 5%. Additionally, IDR plans will now calculate discretionary income by subtracting 225% of the federal poverty level, rather than 150%, from a borrower’s household income.

These changes are expected to provide significant savings to borrowers by reducing the amount of their monthly payments and avoiding compounding interest as a result. To illustrate the benefits of these changes, consider a family of two in Alabama with a household income of $80,000. The changes to the IDR plans would result in their monthly loan payments being reduced by $279, as illustrated below.

Taxability of Debt Forgiveness

As with PPP loans, forgiveness will not be treated as taxable income for federal income tax purposes due to the American Rescue Plan passed in early 2021. However, the taxability of student loan forgiveness at the state level is not as cut and dried. While the majority of states have conformed with federal treatment of forgiven student loans, a handful of states have not. As of September 28, 2022, forgiven student loans will be included in taxable income for borrowers in the following states:

- California

- Indiana

- Minnesota

- Mississippi

- North Carolina

- Wisconsin

Arkansas is the only remaining state that is still reviewing whether forgiven student loans will be included in taxable income. Arkansas, along with New Jersey, Mississippi, and Pennsylvania, does not use federal taxable income or AGI in calculating taxable income within their state. Therefore, rolling conformity with federal treatment requires a more in-depth review at the state level.

Conclusion

The announcement of these changes has garnered a mixed bag of reactions in Washington and among American citizens. Supporters have championed the plan as an enormous win in a long-fought battle, even though the amount of forgiveness was much less than initially anticipated. Many opposed to the move believe that it is a purely political move by the Democratic party ahead of the fall midterm elections. Additionally, borrowers who already paid their loans prior to the announcement have decried the forgiveness as being inequitable. However, borrowers that paid off their loans during the payment pause from the Coronavirus pandemic can still apply for forgiveness and receive a refund on the balances they paid.

In light of the opposition, several lawsuits have arisen across the country to halt the forgiveness. In mid-October, one case filed in Wisconsin was rejected by the U.S. Supreme Court, while another in Missouri was dismissed by a federal judge. The case in Missouri was appealed immediately and a U.S. appeals court ordered a temporary hold on student loan forgiveness. At this time, it is uncertain whether this case will be resolved or how long it will take.

We will continue to monitor developments surrounding student loan forgiveness and payment revisions as they occur and will communicate any relevant updates in a timely manner. If you have any questions or concerns about how these changes may affect your situation, please contact your BMSS advisor at (833) CPA-BMSS.

SOURCES

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/24/fact-sheet-president-biden-announces-student-loan-relief-for-borrowers-who-need-it-most/

- https://studentloansherpa.com/hard-qualify-public-service-loan-forgiveness-pslf/

- https://www.npr.org/2018/10/17/653853227/the-student-loan-whistleblower

- https://www.npr.org/2022/10/26/1131461940/student-loan-forgiveness-pslf

- https://www.nerdwallet.com/article/loans/student-loans/the-new-idr-plan

- https://www.npr.org/2022/10/28/1132107116/biden-student-loans-debt-forgiveness-faq