E-Verify Reporting Requirements

What is E-Verify? E-Verify is an Internet-based system that allows employers to confirm newly hired employees are legally authorized to work in the United States. The E-Verify system compares information

Read More

What is E-Verify? E-Verify is an Internet-based system that allows employers to confirm newly hired employees are legally authorized to work in the United States. The E-Verify system compares information

Read More

In today’s ever evolving world of accounting guidance and regulatory compliance, it’s more important than ever to stay on top of what standards have been issued by the Financial Accounting

Read More

Written by Dalton Hopper, CFE, CVA As part of the 2017 Tax Cuts and Jobs Act, the gift and estate lifetime exclusion amount was raised and is currently set to

Read More

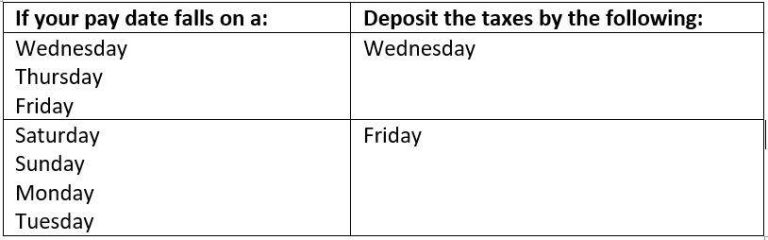

IRS Notice 931, Deposit Requirements for Employment Taxes, https://www.irs.gov/pub/irs-pdf/n931.pdf list requirements for depositing payroll taxes such as federal income tax, social security and Medicare tax. If your company is currently

Read More

As the year draws to a close, it’s important to think about renewing your city business license. Depending on the nature of your business and its location, you may be

Read More

As we approach the end of 2023, it’s essential to plan ahead to ensure that you are well-prepared for the upcoming tax season. Whether you’re an individual, a business owner,

Read More

Written by Sarah Shirley Earlier this fall, the IRS issued a moratorium on the processing of any new Employee Retention Credit (ERC) claims through at least the end of the

Read More

By: Cooper Melvin, CPA, JD In September 2023, the IRS announced a special subdivision of the Large Business and International Division will be dedicated to pass-through entity audits. Partnerships have

Read More