IRS Notice 931, Deposit Requirements for Employment Taxes, https://www.irs.gov/pub/irs-pdf/n931.pdf list requirements for depositing payroll taxes such as federal income tax, social security and Medicare tax. If your company is currently paying Federal 941 payroll taxes on a monthly deposit schedule, then you should be performing an annual checkup to see if you are required to begin paying these taxes on a semi-weekly schedule.

Now is the ideal time to perform this check, as any changes to your deposit schedule should be implemented beginning January 1, 2024. Below is the calculation to make this determination for calendar year 2024:

From Form 941, line 10, determine the total tax amount for each of the following periods:

Third Quarter 2022 $___________________

Fourth Quarter 2022 $___________________

First Quarter 2023 $___________________

Second Quarter 2023 $___________________

Grand Total $___________________

If the total is less than $50,000, your company may remain on the monthly deposit schedule, and your 941 tax deposits are due by the 15th day of the following month.

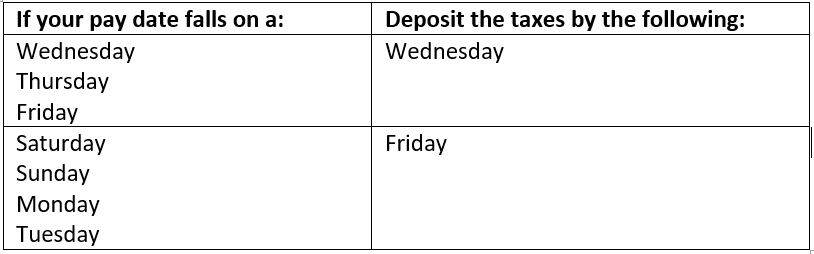

If the total is $50,000 or more, your company is required to change to a semi-weekly deposit schedule. This does not mean you must start paying your taxes on a semi-weekly basis; under the semi-weekly deposit schedule, if your pay date is on a Wednesday, Thursday or Friday, then your tax payment is due by the following Wednesday. If your pay date is on a Saturday, Sunday, Monday or Tuesday, then your tax payment is due on the following Friday.

If you are using the EFTPS system to make these payments, payments over $100,000 must be scheduled no later than 8pm Eastern Time the business day before the deadline considered timely, and payments $100,000 or less may be made no later than 3pm Eastern time on the due date to be considered timely.

You are required to make your payments on business days only; if the due date of your deposit falls on a Saturday, Sunday, or legal holiday, your payment is due the following business day.

SEMI-WEEKLY DEPOSIT SCHEDULE

There is an exception to the above rules: the $100,000 next day deposit rule. If your business accumulates $100,000 or more in taxes on any day during a deposit period, these taxes must be deposited by the next business day. In addition, once a monthly depositor accumulates a $100,000 or more tax liability, they become a semi-weekly depositor for at least the rest of that year and the following calendar year.

If you are a new employer, in the first year of business you are automatically a monthly schedule depositor unless the $100,000 next day deposit rule applies.

If you or your company would like more information about 941 lookback procedures and other common payroll issues, please contact one of our Client Accounting and Advisory Specialists at (256) 539-8002.