Using Data to Measure Morale

Written by Becca Riles, Business Intelligence Analyst, Abacus Technologies Did you know that using data to measure morale within a company is essential for several reasons? Morale refers to the

Read More

Written by Becca Riles, Business Intelligence Analyst, Abacus Technologies Did you know that using data to measure morale within a company is essential for several reasons? Morale refers to the

Read More

The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act of 2019) and the SECURE 2.0 Act of 2022 (collectively, SECURE) enacted a new mandate that, starting

Read More

The wage base limit is the maximum wage that is subject to Social Security tax for that year. In 2023, the Social Security Wage base was $160,200 and is increasing

Read More

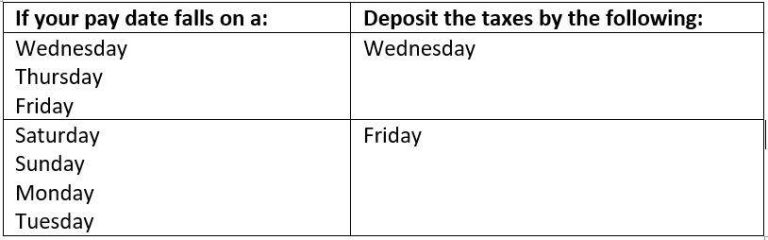

IRS Notice 931, Deposit Requirements for Employment Taxes, https://www.irs.gov/pub/irs-pdf/n931.pdf list requirements for depositing payroll taxes such as federal income tax, social security and Medicare tax. If your company is currently

Read More

By Rebecca Tipton, SHRM-SCP HR Advisory Services We are officially in the final days of 2023, which is historically a time for celebration! However, before you break out your noisemakers

Read More

Written by Sarah Shirley Earlier this fall, the IRS issued a moratorium on the processing of any new Employee Retention Credit (ERC) claims through at least the end of the

Read More

Written by Rebecca Tipton, SHRM-SCP BMSS HR Advisory Putting the “Resource” in Human Resource Consulting As those familiar with the Fair Labor Standards Act will know, designating an employee as

Read More

Written by Rebecca Tipton, SHRM-SCP, BMSS HR Services The I-9 form is one of the main cornerstones of compliance for onboarding so that employers can demonstrate their employees’ eligibility to work

Read More

Written by Rebecca Tipton, SHRM-SCP HR Advisory Services Putting the “Resource” in Human Resource Consulting One of the unexpected challenges of the HR industry is keeping up with compliance updates

Read More

Labor classification splits workers into two categories: Employees and Independent Contractors. Proper classification of workers is an important part of paying for labor and there are several pieces to consider

Read More

Written by Rebecca Tipton, SHRM-SCP BMSS HR Advisory Services Many people might not realize, but April 6th is National Employee Benefits Day, a day to celebrate and embrace the

Read More

By Cooper Melvin, J.D., CPA In a news release today, the IRS warned employers to be wary of third parties who are advising them to claim the Employee Retention Credit

Read More