Tax Credits for COVID-19 Shots

In March, the Biden Administration signed the American Rescue Plan Act of 2021 (ARP), extending the availability of the Emergency Paid Sick Leave (EPSL) tax credit and the Emergency Family

Read More

In March, the Biden Administration signed the American Rescue Plan Act of 2021 (ARP), extending the availability of the Emergency Paid Sick Leave (EPSL) tax credit and the Emergency Family

Read More

One week ago, President Biden outlined a massive $2 trillion infrastructure proposal to address some of the issues that his administration consider to be the country’s most pressing problems, including

Read More

In a previous Beyond the Bottom Line, BMSS briefly highlighted certain Alabama legislation passed earlier this year and signed into law by Governor Ivey. One provision that passed deserves additional

Read More

The SBA announced changes late on March 3rd to the PPP in the attached interim final rule that can impact schedule C filers. These borrowers may now receive, on new

Read More

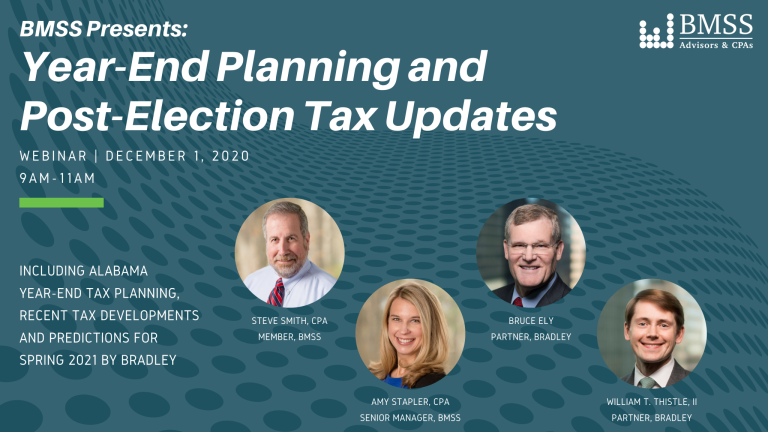

On Tuesday, December 1 we hosted the webinar, BMSS Presents: Year-End Planning and Post-Election Tax Updates. We were also fortunate to have Bradley Partners Bruce Ely and William T. Thistle, II

Read More

Some small businesses may be hit with a surprise tax bill related to Paycheck Protection Program (PPP) loans unless Congress acts soon. If you have been following our emails and

Read More

Beginning November 1, 2020, taxpayers will be required to renew the State of Alabama Tax License annually. The My Alabama Taxes (MAT) website will provide the ability for the business

Read More