Uncertainty Adds Urgency: Potential for Tax Increases Impacts M&A Transactions

Most business owners will buy or sell a company only once in their lifetime. It’s a pivotal moment in the lifecycle of any business as well as for the owner

Read More

Most business owners will buy or sell a company only once in their lifetime. It’s a pivotal moment in the lifecycle of any business as well as for the owner

Read More

By: Barbara Finke, BDO USA Are you tired of the “new normal,” logging into yet another virtual meeting and hoping your internet will hold out for your key presentation? Or

Read More

By: Cooper Melvin J.D., Staff Accountant Recent news has brought a focus on employer-provided fringe benefits and the consequences to employees and businesses if accounting is improper. Compliance with accounting

Read More

In late May of 2021, the Treasury Department issued the “General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals,” (the “Proposal”) also known as the “Green Book.” The tax

Read More

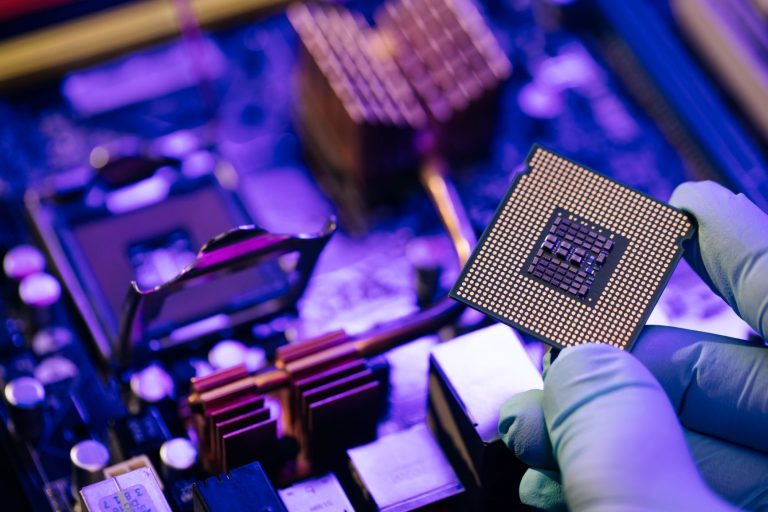

A shortage of processors and other components could affect the availability and price of IT hardware for the next 12 to 18 months, according to major tech companies including Intel, Dell,

Read More

In the last Beyond the Bottom Line newsletter, BMSS briefly discussed the Advance Child Tax Credit under the American Rescue Plan enacted in March 2021. The IRS will pay half

Read More

Many of you may have received a letter from the IRS regarding the Advanced 2021 Child Tax Credit. As part of the American Rescue Plan Act, an increase in the

Read More

On Friday, May 28, 2021, the Treasury Department issued the “General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals.” Also known as the “Green Book,” the 114-page document is

Read More

Written by BMSS Supervisor Dalton Hopper, CFE One of the most commonly asked questions from clients is, “What’s my business worth?” Whether you are planning to buy or sell a business,

Read More

As some of you may know, there has been an uptick in fraudulent unemployment claims throughout the state. With the influx of cases arising from shutdowns during the pandemic, state

Read More

In March, the Biden Administration signed the American Rescue Plan Act of 2021 (ARP), extending the availability of the Emergency Paid Sick Leave (EPSL) tax credit and the Emergency Family

Read More

One week ago, President Biden outlined a massive $2 trillion infrastructure proposal to address some of the issues that his administration consider to be the country’s most pressing problems, including

Read More